What Works for Small Emerging and Minority Business Enterprises (MBEs) in the Department of Energy's Loan Program Office

Introduction

The Department of Energy's Loan Programs Office (LPO) is crucial in advancing the United States toward a sustainable and energy-independent future, providing critical financial assistance through loans and loan guarantees for innovative energy projects. However, with political shifts and potential administrative changes under discussion, the operational framework of the LPO may see significant modifications. This article explores how small, emerging, and minority business enterprises (MBEs) can navigate and leverage these opportunities, particularly in light of potential reforms discussed in political circles.

VIEW PODCAST

The Evolving Landscape of the LPO

Recent discussions, as highlighted by E&E News, suggest potential reforms or even dismantling of the LPO. Some Republican figures, motivated by a desire to broaden the range of supported energy sources and improve efficiency, advocate for significant changes. This includes potential shifts to support not only clean energy but also nuclear and geothermal projects under the proposed Department of Government Efficiency (DOGE).

Implications for MBEs

These proposed changes could reshape the types of projects funded by the LPO. MBEs in the clean energy sector might face new challenges but could also find opportunities in expanded energy categories. Staying informed about these political and policy developments is crucial for MBEs planning to seek LPO financing.

Navigating LPO Programs Amidst Political Changes

Understanding the LPO's current programs is crucial for MBEs. However, with potential policy shifts, MBEs must also prepare for changes in application processes and funding priorities.

Current LPO Programs

- Title 17 Innovative Energy Loan Guarantee Program: This program supports a wide array of projects aimed at reducing greenhouse gas emissions.

- Advanced Technology Vehicles Manufacturing (ATVM) Program: This initiative helps companies produce fuel-efficient vehicles and related technologies.

- Tribal Energy Loan Guarantee Program (TELGP): TELGP focuses on supporting tribal energy development projects, enhancing economic growth and sovereignty through energy independence.

Preparing for Changes

MBEs should engage in strategic planning and continuous monitoring of the LPO’s announcements. Understanding potential policy directions and preparing for shifts in funding priorities will be key to navigating the evolving landscape.

Application Strategies for MBEs

Despite potential changes, the core of successful LPO applications will likely remain centered on innovation, environmental impact, and economic viability.

Key Application Components

- Business Plan: Clearly articulate the innovation and its benefits.

- Environmental Impact: Demonstrate how the project contributes to environmental sustainability.

- Economic Model: Show the project's financial viability and prospects for success.

Responding to New Priorities

If new energy categories are favored due to policy changes, MBEs should consider adapting their project scopes to align with these areas. Collaborating with partners in nuclear, geothermal, or other supported sectors could provide new opportunities.

Overcoming Challenges

Navigating federal financing involves overcoming significant challenges, including complex regulatory environments and rigorous documentation requirements.

Technical Compliance and Advisory Services

Utilizing consultants experienced in federal project financing can help MBEs ensure compliance with technical requirements and optimize their financial strategies.

Building Networks

Establishing partnerships with other stakeholders in the energy sector can enhance project credibility and resource access, crucial for navigating potential shifts in LPO focus.

Future Outlook and Strategic Adaptation

The energy sector's future is inherently tied to political landscapes. For MBEs, adaptability to policy changes, proactive engagement with stakeholders, and strategic planning are essential for leveraging LPO opportunities effectively.

Conclusion

The LPO remains a vital resource for MBEs, offering opportunities to contribute significantly to the U.S. energy sector's transformation. However, the potential changes discussed could impact how these businesses engage with the LPO. By staying informed, preparing for new opportunities, and adapting to shifts in policy and priorities, MBEs can continue to thrive. For more detailed guidance on engaging with these programs and adjusting to new LPO dynamics, MBEs should regularly consult resources provided by entities like the MBDA Federal Procurement Center.

Source:

Portuondo, N. (2024, December 3). Republicans mull fate of DOE loan program. E&E News by POLITICO. https://www.eenews.net/articles/republicans-mull-fate-of-doe-loan-program-2/

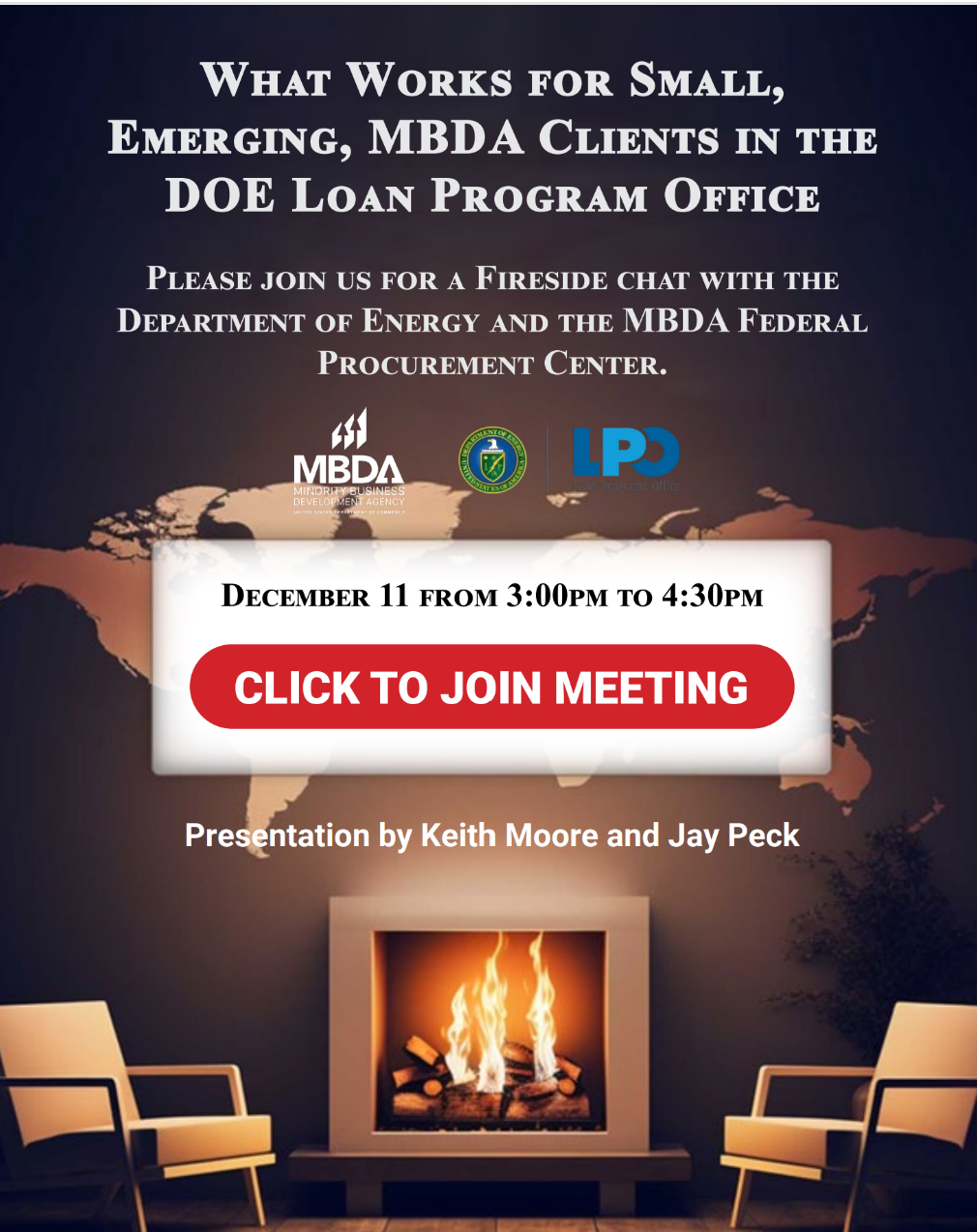

ATTEND THE WEBINAR

Event Details:

- Date: December 11, 2024

- Time: 3:00 PM - 4:30 PM

Click here to join the meeting

Meeting ID: 286 107 488 909

Passcode: gm3Qo9Ud

Dial in by phone

+1 253-292-3452,,244912900# United States, Tacoma

Phone conference ID: 244 912 900#

For organizers: Meeting options | Reset dial-in PIN